COVID-19 has had far-reaching impacts on the economies of the world and in turn the global financial markets. It has caused an unprecedented economic crisis, similar to the crisis in 2008 when Bitcoin was first created with many areas of the markets become volatile and unpredictable, traders have been left uncertain and looking for different areas of the market to focus on. Particularly, areas that aren’t as easily impacted by things like inflation, interest rates and economic downturns.

When it comes to foreign exchange trading, the ever-popular US dollar has been at the mercy of not only COVID-19’s effects, but also the geopolitical tensions between the US and China, and subsequent sanctions against China in 2020. There is some hope that the US economy is on the way to recovery. However, the dollar remains at lows that haven’t been seen since 2018.2 With the dollar being affected by things like interest rates and other economic activity, it’s had a wild ride since the beginning of 2020, largely thanks to the effects of the virus on the US economy.

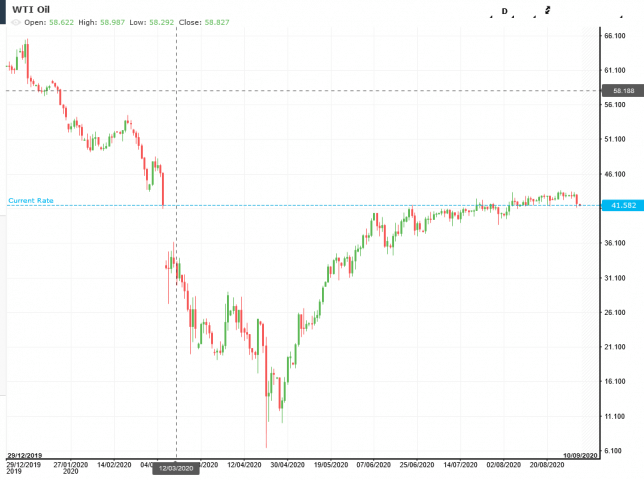

Oil has also been an extremely volatile area of the market so far this year, thanks to nationwide lockdowns which caused major declines in the amount of fuel being used across the world, as well as a decline in importing and exporting. According to the International Monetary Fund, this year oil prices will be 41% lower than in 2019, as the global oil demand drops by 8% year on year.

WTI oil price fell by over 70% between the beginning of 2020 and April 20th. Even though prices have somewhat recovered, adding over 200% by September 1st, they remain far from their January highs.

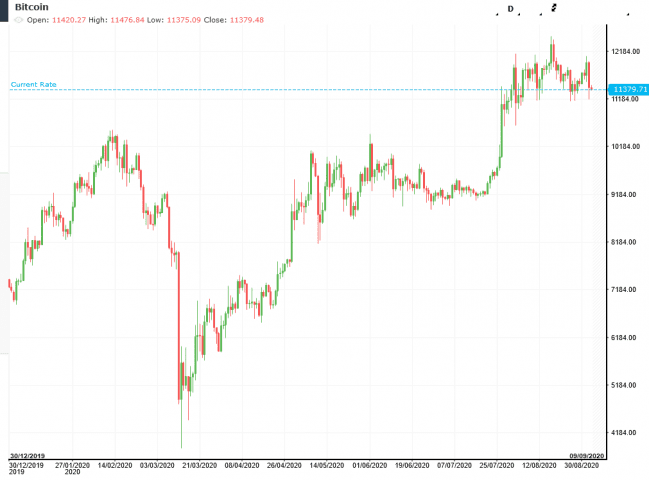

All the market volatility and uncertainty amongst the more traditional trading instruments has led many traders to Bitcoin. Bitcoin is powered by decentralized blockchain technology which makes it less susceptible to changes in economic activity and politics.1 Wall Street has chased both gold and Bitcoin as less volatile, more stable assets, with which to hedge against inflation.4 The trading of Bitcoin increased sharply at the beginning of the year, as traders rushed to find so-called safer and perhaps more stable places to put their money.5 These higher levels jumped again in February and were sustained throughout the year, until May.5 The cryptocurrency has become so popular that a study from Cornerstone Advisors revealed that 15% of American adults now own some form of cryptocurrency.5 Bitcoin kicked off September at $11,309.66 and traders were watching closely to see if it breaks through the $12,000 resistance level.6 The crypto giant is up by a sizeable 30% year on year, and after an earlier crash, has proven resilient amidst the coronavirus devastation.

What’s next for Bitcoin?

If you trade Bitcoin CFDs, we’re sure you want to know what will happen next. The answer is that no one knows what the future holds, but some people certainly have an opinion. “Our view for the balance of 2020 is still high volatility with a year-end of around $7,000 [per bitcoin] with a drive higher to new highs in 2021,” Gavin Smith, the chief executive of bitcoin and crypto consortium Panxora.8 Is he right? Only time will tell. In the meantime, the cryptocurrency king has not only gone from strength to strength in 2020 but is poised to keep growing as the world emerges from the virus damage, according to US congressman Tom Emmer.1 “There are things happening that are going to disrupt the centralized nature of our society. We’re about to blow that whole thing up, because of the pandemic, I believe,” Emmer said.

However, if 2020 has taught us anything, nothing is certain, and things can easily change at the drop of a hat. The way to move forward is perhaps with caution and open eyes, and to stay on top of the latest developments across the markets. As traders know, the market can change fast, and information is essential for making an informed decision.